6,000 after writing off Bad Debts Rs 150 and allowing discounts Rs. 1. The provision for the bad debt is an expense for the business and a charge is made to the income statements through the bad debt expense account. A. D10,000 B. D9,000 C. D1,000 D. D400. If, instead, the allowance for uncollectible accounts began with a balance of $10,000 in June, we would make the following adjusting entry instead: 120,000. Dr Bad Debts Cr Debtors Control Some managers in this situation would then consider increasing the provision for doubtful debts account as it is not reflecting what the bad debts are really coming to. 175. There is no implication on the customer account or the VAT, until you write the debt off. 12,000 (2-3). Write off Rs 5,000 as bad debts and make a provision for doubtful debts @ 10 % on sundry debtors. EXAMPLE OF A SPECIFIC PROVISION ABC Ltd is a customer of Marias business and has an outstanding amount as at 31/12/2021 of $2,000 due to Marias business. He decided to maintain the provision for doubtful debts at the rate of 4 % of the debtors.  Example #1 As on 01.01.2012 Provision for Bad Debts Bad Debts Bad Debts can be described as unforeseen loss incurred by a business organization on account of non-fulfillment of agreed terms and conditions on account of sale of goods or services or repayment of any loan or other obligation.

Example #1 As on 01.01.2012 Provision for Bad Debts Bad Debts Bad Debts can be described as unforeseen loss incurred by a business organization on account of non-fulfillment of agreed terms and conditions on account of sale of goods or services or repayment of any loan or other obligation.  If you remember Step 1 in the previous post, we will need to calculate the provision of doubtful debts. Provision for doubtful debts that is often referred to as provision for bad debts is recorded in anticipation of probable bad debts that might arise in accounts receivable.

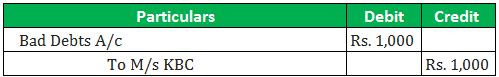

If you remember Step 1 in the previous post, we will need to calculate the provision of doubtful debts. Provision for doubtful debts that is often referred to as provision for bad debts is recorded in anticipation of probable bad debts that might arise in accounts receivable.  (BD=5000-2500 (PBD) = Balance Bad Debts is 2500. Write offf Rs 5,000 as bad debts Journal entries. On 31.12.2002: Sundry Debtors Rs. Step 5: Apply the credit memo. The Original Entry is: Debit : Provision for doubtful debt ( Income Statement) 100,000. Credit: Provision for doubtful debt ( Balance Sheet) 100,000. asked Nov 7, 2021 in Accounts by RakheeChawla (74.3k points) class-11; adjustments-in-preparation-of-financial-statements; Bad Debts A/c Dr. 2500. Journal Entries: Bad debt is treated as an expense, hence debited in the Income statement. Journal Entry for Creating a Provision for Discount on Debtors: Profit & Loss A/c -----Dr. To Provision for Discount on Debtors A/c Bad debts are uncollectible invoices that are written-off from the accounts receivable after all attempts of recovery have been made. To Provision for doubtful debts 12,000. Provision For Doubtful Accounts Entry will sometimes glitch and take you a long time to try different solutions. Debit. For example: Trade receivables $10 000. The management should prepare a list of all such debts and present it before the board in its meeting in order to take the approval.

(BD=5000-2500 (PBD) = Balance Bad Debts is 2500. Write offf Rs 5,000 as bad debts Journal entries. On 31.12.2002: Sundry Debtors Rs. Step 5: Apply the credit memo. The Original Entry is: Debit : Provision for doubtful debt ( Income Statement) 100,000. Credit: Provision for doubtful debt ( Balance Sheet) 100,000. asked Nov 7, 2021 in Accounts by RakheeChawla (74.3k points) class-11; adjustments-in-preparation-of-financial-statements; Bad Debts A/c Dr. 2500. Journal Entries: Bad debt is treated as an expense, hence debited in the Income statement. Journal Entry for Creating a Provision for Discount on Debtors: Profit & Loss A/c -----Dr. To Provision for Discount on Debtors A/c Bad debts are uncollectible invoices that are written-off from the accounts receivable after all attempts of recovery have been made. To Provision for doubtful debts 12,000. Provision For Doubtful Accounts Entry will sometimes glitch and take you a long time to try different solutions. Debit. For example: Trade receivables $10 000. The management should prepare a list of all such debts and present it before the board in its meeting in order to take the approval.  Credit. Company A decides to create a provision for doubtful debts that will be 2% of the total receivables balance. At the time of its bankruptcy, RD owed PS an amount of $3.5 million. Balance Sheet. 3:55. You are required to pass the necessary journal entries, prepare Provision for Doubtful Debts Account and show how the different items appear in the Final Accounts. The allowance is increased by the provision for doubtful accounts and recoveries of previously written off receivables and is decreased by the write-off of uncollectible receivables. During the financial year ended 31 December 20X4, PS wrote off RD account as follows because it expected zero recovery. The entry for creating provision for doubtful debts is debit and credit provision for doubtful debts account. Journal Entry:. 5:06. In Quarter 2, We increase the provision by an additional $50,000 namely:- The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. Provision for doubtful debts which is often referred to as provision for bad debts is recorded in anticipation of probable bad debts that might arise in accounts receivable. 300. Step#1 Bad debt provision (start of year) Bad debt exp (dr.)100 Provision for Bad debts. In this case, under the direct write-off method the company can record the bad debt expense journal entry as below: Account. This loss of revenue is referred to as a bad debt expense. Allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables appearing in the balance sheet. A corresponding debit entry is recorded to account for the expense of the potential loss. Accounting entry to record the allowance for receivable is as follows: )100 Step#2 write of actual bad debt (when we are confirmed that we aren't gonna collect the payment from this customer) Provision for bad debt (dr.)100 Account Receivable (cr)100 Note: Provision for Bad debt is Contra Asset Account. What is the journal entry for doubtful debts? Bad debts A/C Dr 5000. LEDGER Provision for Doubtful Debts Account But this is not sufficient. Heres how it works. It is charged against the current years profits. Credit Bad provision 100 B/S. Doubtful Debts (P&L expense a/c) xxx Cr. To Receivable Account -Cr. Allowance of Doubtful Accounts. Additional provision to be maintained = Rs. 51,000. Income Statement. LoginAsk is here to help you access Provision For Doubtful Accounts quickly and handle each specific case you encounter. entry will be P/L -dr, Provision for doubtful- Cr. The following journal entry is made to record a reduction in provisions for bad or doubtful debts: Dr: Provision for bad debts account; Cr: Profit & Loss Account; Example. At the end of the accounting period for the year 2020, Company X has estimated that 20% of their Accounts Receivable balance will become uncollectible based on the companys previous history. Provision for Discount on Debtors Rs. If the total credit sales is of $100,000, then the allowance for doubtful debts would be (as per Pareto principle) = ($100,000 *20%) = $20,000. 1) Increase in provision of doubtful debts 2) No change in provision of doubtful debts 3) Decrease in provision of doubtful debts. Closing provision for doubtful debts to be maintained @ 10% = Rs. For this purpose the following entries are required to be passed: (b) Cash Basis Method: No separate entry is required for Interest on doubtful loans. Below are the examples of provisions for a bad debt journal entry. There are two types of doubtful debt allowances. As per this percentage, the estimated provision for bad debts is $12,000 ( [$110,000 $10,000] x 10%). REQUIRED Show the journal entry in the books of the business. To Provision for Doubtful Debts. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. It has been decided that an allowance for doubtful debt is to be created. Accounting treatment for provision for doubtful debts: 1. SOLUTION In this case the debt from ABC Ltd Every year the amount gets changed due to the provision made in the current year. Accounting and journal entry for recording bad debts involves two accounts Bad Debts Account & Debtors Account (Debtors Name). In other words, collection from debtors if clearly becomes uncollectable called as bad debts. (being cash received from Mahesh and bad debts written) Bad is loss and shown in the Debit side of Profit and loss accounts therefore it reduces the profit of the firm. At the time of its bankruptcy, RD owed PS an amount of $3.5 million. Example. Show Answer. 000. Journal Entry for Bad Debt Provision. Provision for doubtful debts brought forward at 1st January, 1997 was N600. B. Provision for doubtful debts Journal Entries. Credit The amount owed by the customer is still 500 and remains as a debit on the debtors control account. Accounting Entries For Provision for Discount on Debtors: Discount is allowed only to the good debtors and the provision is calculated after deducting the provision of doubtful debts. Provisions for bad debts at 2% of this amount would come to $7,000. 6 0 0 0 being amount due from the proprietor for his personal expenses paid by the firm Debtors includes Rs. First off, since you are receiving cash from the customer the following year, you have to record that at that point, and the contra entry As per Bad Debt Provision: Overview, Calculate, And Journal Provision For Doubtful Accounts Entry will sometimes glitch and take you a long time to try different solutions. Bad debts actually written off in the year are $5,420. Provision for doubtful debts. Provision for doubtful debts Journal Entries. Allowance for Doubtful Debts (Balance Sheet) $500. During the financial year ended 31 December 20X4, PS wrote off RD account as follows because it expected zero recovery. $2,000. Here are templates of resolutions passed in the meeting of the board of directors for making provision for bad and doubtful debts. Redway, Inc. (RD), a major client of Pluscore, LLC (PS) went bankrupt in financial year 20X4. Please refer to relevant provisions under the law and make changes accordingly. How to calculate provision for debts? To predict your companys bad debts, create an allowance for doubtful accounts entry. As a general allowance of $1500 has already been created, only $500 additional allowance must be charged to the income statement: Debit. It is identical to the allowance for doubtful accounts. For example, company XYZ Ltd. decides to write off one of its customers, Mr. Z as uncollectible with a balance of USD 350. From the following details estimate the provision for doubtful debts to be made Debtors as on 31.03.09 Rs. Create a Provision for Doubtful Debts @ 10% on Debtors. Youd enter this in your businesss accounting journal like so: Account. Scenario 1: During the year, the debtors are $3,000. Journal Entry for provision for Bad debts: -. Debtors at the end of the year are $350,000. The journal entry for creating this allowance for doubtful debt is as follows: 63,000. CR Provision for doubtful debts. For example, company XYZ Ltd. decides to write off one of its customers, Mr. Z as uncollectible with a balance of USD 350. . There are two types of doubtful debt allowances. The entry for creating provision for doubtful debts is debit and credit provision for doubtful debts account. Bad debt expense. The detailed information for Allowance For Doubtful Accounts Journal Entries is provided. The entries are: Now you wish to write off a specific customer's invoice or portion thereof. Actual Bad Debts = 50000 x 10% = 5000.00. Provision for doubtful debts= 10% $10 000 = $1 000 read more is 5,000 ; Provision for bad debts account Dr. xxxxxx To Bad Debts account xxxxx Transfer of provision for bad debts account to profit and loss account 3. However, ABC Co. already has $7,000 in the provision for doubtful debt accounts from the previous year. I've read conflicting answers previously. 9:55. Pas. However, David still wants to maintain a provision for bad debts at 2% of debtors. allow 5% on debtors for provision for bad dabts & 10% for. LoginAsk is here to help you access Provision For Doubtful Accounts Entry quickly and handle each specific case you encounter. 10,000 after writing off Bad Debts Rs 250 and allowing discounts Rs. That is not time for journal entry but to apply the credit memo . Where do doubtful debts go? bAD DEBTS MEANS AMOUNT WHICH cannot be recovered from the debtors,in this case entry will be , Bad dedts -Dr, debtors-Cr, On the other hand hand ,provision is the amount which recovery is suspectible. The double entry for recording provision for doubtful debt is: Dr. When you decide to write off an account, debit allowance for doubtful accounts. $3,500,000. Example. Allowance For Doubtful Accounts - Accounts Receivable. 000. In Quarter 2, We increase the provision by an additional $50,000 namely:- In this case, under the direct write-off method the company can record the bad debt expense journal entry as below: Account. Bad debt Account; credit Sales Account B. Create a GL Current Liability account eg 9400000 Provision for bad debts. A. In provision method, it is common to provide 3% to 5% of the accounts receivable as a doubtful debts allowance (Provision for Doubtful Debts). Debit the bad debts expense and credit the provision. Therefore, the journal entries for When it comes to bad debt and ADA, there are a few scenarios you may need to record in your books. The entries required to reinstate a debt when recovered from a debtor are: debit A. Journal for a Specific Doubtful Debt Allowance Paid by: Anonymous What would the double entry be if you've made a specific provision for doubtful debts then the following year the customer pays? In January 2022, the accountant of the business is informed that ABC Ltd has gone bankrupt. Credit. LoginAsk is here to help you access Provision For Doubtful Accounts quickly and handle each specific case you encounter. For e.g. IFRS 9 permits using a few practical expedients and one of them is a provision matrix. Provision for doubtful debts 1 450 During the year ended 31 August 2016 Debts written off 2 064 On 31 August 2016 Trade receivables 79 650 On 31 August 2016 it was decided to write off $250 owed by Uzma. provision for bad debt for the year is expected to be 5% of Rs. Examples of Provision for Bad (and Doubtful) Debts Journal Entries. Help users access the login page while offering essential notes during the login process. When debts are unrecoverable, debts turn bad bad debts. Since interest on such loans comes under Non-performing Assets, as such, such interest should not be recognized from conservatism point of view cash basis method is the best one. So, you can calculate the provision for bad debts as follows: 100000 x 2% = 2,000. EXAMPLE OF A SPECIFIC PROVISION ABC Ltd is a customer of Marias business and has an outstanding amount as at 31/12/2021 of $2,000 due to Marias business. One is a specific allowance, and the other one is a general allowance. The journal entry in the above example would therefore be: Simply said, it is a calculation of the impairment loss based on the default rate percentage applied to the group of financial assets. Allowance For Doubtful Accounts - Accounts Receivable. To Provision for bad debts A/C 5000. The journal entry passed to record the event is as follows: Bad Debt Exp Dr. Learn provision for doubtful debts in Tally ERP 9. In tally, bad debt entry is made through a journal voucher; In case of bad debt, the accounting entry are made as under : Dr. Bad Debt Account (Under Group Indirect Expenses) Cr. Illustration 4: On December 2004, Mr. Ram closes his books when his Debtors amounted to Rs 25,000. Journal entries *) (4 % x $ 28,000) - $ 1,000. 450. Provision For Doubtful debts takes into consideration that when a company conducts it business, there is bound to be some billings during the year whereby the customers might not be able to pay hence eventually turning bad. Entry for transferring bad debts to provision for bad debts Account 2. Double entry of provision for doubtful debt? On the other hand, due to bad debt expense, the total amount of trade receivable is reduced as well. 000. Bad debt expense. 400. So, you can calculate the provision for bad debts as follows: 100000 x 2% = $2,000. The three primary components of the allowance method are as follows: Estimate uncollectible receivables. 2. The provision for doubtful debts was adjusted to 2% of the remaining trade receivables. To reduce a provision, which is a credit, we enter a debit. To Mahesh. At the end of the year, the list of debtors may still contain some debts which are doubtful of recovery. 8 0 0 0 0 0 Bill received includes B/R Rs. Provision for bad debts. When you decide to write off an account, debit allowance for doubtful accounts. DR Income statement. (Being additional provision on doubtful debts maintained @ 10%) Cash A/c Dr. 30,000. When an amount becomes irrecoverable from debtors the amount is debited to the Baddebts account and credited to the personal account of the debtors. Assuming, as of 31 Dec 2013, you have an account receivable of 100,000, based on a 5% doubtful debts allowance, the journal entry will be: This works in the same way as accumulated depreciation is deducted from the fixed asset cost account. (3) Journal entries for provisions for doubtful debts (a) The Group Controller, FCT must approve any provision for doubtful debts calculated in accordance with subclause 7(2) which varies from the current provision stated in the general ledger. The debit to bad debts expense would report credit losses of $50,000 on the companys June income statement.

Credit. Company A decides to create a provision for doubtful debts that will be 2% of the total receivables balance. At the time of its bankruptcy, RD owed PS an amount of $3.5 million. Balance Sheet. 3:55. You are required to pass the necessary journal entries, prepare Provision for Doubtful Debts Account and show how the different items appear in the Final Accounts. The allowance is increased by the provision for doubtful accounts and recoveries of previously written off receivables and is decreased by the write-off of uncollectible receivables. During the financial year ended 31 December 20X4, PS wrote off RD account as follows because it expected zero recovery. The entry for creating provision for doubtful debts is debit and credit provision for doubtful debts account. Journal Entry:. 5:06. In Quarter 2, We increase the provision by an additional $50,000 namely:- The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. Provision for doubtful debts which is often referred to as provision for bad debts is recorded in anticipation of probable bad debts that might arise in accounts receivable. 300. Step#1 Bad debt provision (start of year) Bad debt exp (dr.)100 Provision for Bad debts. In this case, under the direct write-off method the company can record the bad debt expense journal entry as below: Account. This loss of revenue is referred to as a bad debt expense. Allowance for doubtful debts is created by forming a credit balance which is netted off against the total receivables appearing in the balance sheet. A corresponding debit entry is recorded to account for the expense of the potential loss. Accounting entry to record the allowance for receivable is as follows: )100 Step#2 write of actual bad debt (when we are confirmed that we aren't gonna collect the payment from this customer) Provision for bad debt (dr.)100 Account Receivable (cr)100 Note: Provision for Bad debt is Contra Asset Account. What is the journal entry for doubtful debts? Bad debts A/C Dr 5000. LEDGER Provision for Doubtful Debts Account But this is not sufficient. Heres how it works. It is charged against the current years profits. Credit Bad provision 100 B/S. Doubtful Debts (P&L expense a/c) xxx Cr. To Receivable Account -Cr. Allowance of Doubtful Accounts. Additional provision to be maintained = Rs. 51,000. Income Statement. LoginAsk is here to help you access Provision For Doubtful Accounts quickly and handle each specific case you encounter. entry will be P/L -dr, Provision for doubtful- Cr. The following journal entry is made to record a reduction in provisions for bad or doubtful debts: Dr: Provision for bad debts account; Cr: Profit & Loss Account; Example. At the end of the accounting period for the year 2020, Company X has estimated that 20% of their Accounts Receivable balance will become uncollectible based on the companys previous history. Provision for Discount on Debtors Rs. If the total credit sales is of $100,000, then the allowance for doubtful debts would be (as per Pareto principle) = ($100,000 *20%) = $20,000. 1) Increase in provision of doubtful debts 2) No change in provision of doubtful debts 3) Decrease in provision of doubtful debts. Closing provision for doubtful debts to be maintained @ 10% = Rs. For this purpose the following entries are required to be passed: (b) Cash Basis Method: No separate entry is required for Interest on doubtful loans. Below are the examples of provisions for a bad debt journal entry. There are two types of doubtful debt allowances. As per this percentage, the estimated provision for bad debts is $12,000 ( [$110,000 $10,000] x 10%). REQUIRED Show the journal entry in the books of the business. To Provision for Doubtful Debts. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. It has been decided that an allowance for doubtful debt is to be created. Accounting treatment for provision for doubtful debts: 1. SOLUTION In this case the debt from ABC Ltd Every year the amount gets changed due to the provision made in the current year. Accounting and journal entry for recording bad debts involves two accounts Bad Debts Account & Debtors Account (Debtors Name). In other words, collection from debtors if clearly becomes uncollectable called as bad debts. (being cash received from Mahesh and bad debts written) Bad is loss and shown in the Debit side of Profit and loss accounts therefore it reduces the profit of the firm. At the time of its bankruptcy, RD owed PS an amount of $3.5 million. Example. Show Answer. 000. Journal Entry for Bad Debt Provision. Provision for doubtful debts brought forward at 1st January, 1997 was N600. B. Provision for doubtful debts Journal Entries. Credit The amount owed by the customer is still 500 and remains as a debit on the debtors control account. Accounting Entries For Provision for Discount on Debtors: Discount is allowed only to the good debtors and the provision is calculated after deducting the provision of doubtful debts. Provisions for bad debts at 2% of this amount would come to $7,000. 6 0 0 0 being amount due from the proprietor for his personal expenses paid by the firm Debtors includes Rs. First off, since you are receiving cash from the customer the following year, you have to record that at that point, and the contra entry As per Bad Debt Provision: Overview, Calculate, And Journal Provision For Doubtful Accounts Entry will sometimes glitch and take you a long time to try different solutions. Bad debts actually written off in the year are $5,420. Provision for doubtful debts. Provision for doubtful debts Journal Entries. Allowance for Doubtful Debts (Balance Sheet) $500. During the financial year ended 31 December 20X4, PS wrote off RD account as follows because it expected zero recovery. $2,000. Here are templates of resolutions passed in the meeting of the board of directors for making provision for bad and doubtful debts. Redway, Inc. (RD), a major client of Pluscore, LLC (PS) went bankrupt in financial year 20X4. Please refer to relevant provisions under the law and make changes accordingly. How to calculate provision for debts? To predict your companys bad debts, create an allowance for doubtful accounts entry. As a general allowance of $1500 has already been created, only $500 additional allowance must be charged to the income statement: Debit. It is identical to the allowance for doubtful accounts. For example, company XYZ Ltd. decides to write off one of its customers, Mr. Z as uncollectible with a balance of USD 350. From the following details estimate the provision for doubtful debts to be made Debtors as on 31.03.09 Rs. Create a Provision for Doubtful Debts @ 10% on Debtors. Youd enter this in your businesss accounting journal like so: Account. Scenario 1: During the year, the debtors are $3,000. Journal Entry for provision for Bad debts: -. Debtors at the end of the year are $350,000. The journal entry for creating this allowance for doubtful debt is as follows: 63,000. CR Provision for doubtful debts. For example, company XYZ Ltd. decides to write off one of its customers, Mr. Z as uncollectible with a balance of USD 350. . There are two types of doubtful debt allowances. The entry for creating provision for doubtful debts is debit and credit provision for doubtful debts account. Bad debt expense. The detailed information for Allowance For Doubtful Accounts Journal Entries is provided. The entries are: Now you wish to write off a specific customer's invoice or portion thereof. Actual Bad Debts = 50000 x 10% = 5000.00. Provision for doubtful debts= 10% $10 000 = $1 000 read more is 5,000 ; Provision for bad debts account Dr. xxxxxx To Bad Debts account xxxxx Transfer of provision for bad debts account to profit and loss account 3. However, ABC Co. already has $7,000 in the provision for doubtful debt accounts from the previous year. I've read conflicting answers previously. 9:55. Pas. However, David still wants to maintain a provision for bad debts at 2% of debtors. allow 5% on debtors for provision for bad dabts & 10% for. LoginAsk is here to help you access Provision For Doubtful Accounts Entry quickly and handle each specific case you encounter. 10,000 after writing off Bad Debts Rs 250 and allowing discounts Rs. That is not time for journal entry but to apply the credit memo . Where do doubtful debts go? bAD DEBTS MEANS AMOUNT WHICH cannot be recovered from the debtors,in this case entry will be , Bad dedts -Dr, debtors-Cr, On the other hand hand ,provision is the amount which recovery is suspectible. The double entry for recording provision for doubtful debt is: Dr. When you decide to write off an account, debit allowance for doubtful accounts. $3,500,000. Example. Allowance For Doubtful Accounts - Accounts Receivable. 000. In Quarter 2, We increase the provision by an additional $50,000 namely:- In this case, under the direct write-off method the company can record the bad debt expense journal entry as below: Account. Bad debt Account; credit Sales Account B. Create a GL Current Liability account eg 9400000 Provision for bad debts. A. In provision method, it is common to provide 3% to 5% of the accounts receivable as a doubtful debts allowance (Provision for Doubtful Debts). Debit the bad debts expense and credit the provision. Therefore, the journal entries for When it comes to bad debt and ADA, there are a few scenarios you may need to record in your books. The entries required to reinstate a debt when recovered from a debtor are: debit A. Journal for a Specific Doubtful Debt Allowance Paid by: Anonymous What would the double entry be if you've made a specific provision for doubtful debts then the following year the customer pays? In January 2022, the accountant of the business is informed that ABC Ltd has gone bankrupt. Credit. LoginAsk is here to help you access Provision For Doubtful Accounts quickly and handle each specific case you encounter. For e.g. IFRS 9 permits using a few practical expedients and one of them is a provision matrix. Provision for doubtful debts 1 450 During the year ended 31 August 2016 Debts written off 2 064 On 31 August 2016 Trade receivables 79 650 On 31 August 2016 it was decided to write off $250 owed by Uzma. provision for bad debt for the year is expected to be 5% of Rs. Examples of Provision for Bad (and Doubtful) Debts Journal Entries. Help users access the login page while offering essential notes during the login process. When debts are unrecoverable, debts turn bad bad debts. Since interest on such loans comes under Non-performing Assets, as such, such interest should not be recognized from conservatism point of view cash basis method is the best one. So, you can calculate the provision for bad debts as follows: 100000 x 2% = 2,000. EXAMPLE OF A SPECIFIC PROVISION ABC Ltd is a customer of Marias business and has an outstanding amount as at 31/12/2021 of $2,000 due to Marias business. One is a specific allowance, and the other one is a general allowance. The journal entry in the above example would therefore be: Simply said, it is a calculation of the impairment loss based on the default rate percentage applied to the group of financial assets. Allowance For Doubtful Accounts - Accounts Receivable. To Provision for bad debts A/C 5000. The journal entry passed to record the event is as follows: Bad Debt Exp Dr. Learn provision for doubtful debts in Tally ERP 9. In tally, bad debt entry is made through a journal voucher; In case of bad debt, the accounting entry are made as under : Dr. Bad Debt Account (Under Group Indirect Expenses) Cr. Illustration 4: On December 2004, Mr. Ram closes his books when his Debtors amounted to Rs 25,000. Journal entries *) (4 % x $ 28,000) - $ 1,000. 450. Provision For Doubtful debts takes into consideration that when a company conducts it business, there is bound to be some billings during the year whereby the customers might not be able to pay hence eventually turning bad. Entry for transferring bad debts to provision for bad debts Account 2. Double entry of provision for doubtful debt? On the other hand, due to bad debt expense, the total amount of trade receivable is reduced as well. 000. Bad debt expense. 400. So, you can calculate the provision for bad debts as follows: 100000 x 2% = $2,000. The three primary components of the allowance method are as follows: Estimate uncollectible receivables. 2. The provision for doubtful debts was adjusted to 2% of the remaining trade receivables. To reduce a provision, which is a credit, we enter a debit. To Mahesh. At the end of the year, the list of debtors may still contain some debts which are doubtful of recovery. 8 0 0 0 0 0 Bill received includes B/R Rs. Provision for bad debts. When you decide to write off an account, debit allowance for doubtful accounts. DR Income statement. (Being additional provision on doubtful debts maintained @ 10%) Cash A/c Dr. 30,000. When an amount becomes irrecoverable from debtors the amount is debited to the Baddebts account and credited to the personal account of the debtors. Assuming, as of 31 Dec 2013, you have an account receivable of 100,000, based on a 5% doubtful debts allowance, the journal entry will be: This works in the same way as accumulated depreciation is deducted from the fixed asset cost account. (3) Journal entries for provisions for doubtful debts (a) The Group Controller, FCT must approve any provision for doubtful debts calculated in accordance with subclause 7(2) which varies from the current provision stated in the general ledger. The debit to bad debts expense would report credit losses of $50,000 on the companys June income statement.

provision for doubtful debts journal entry