Securities registered pursuant to Section 12(g) of the Act: None. "/> $19,200 for the first year with bonus depreciation.

$16,400 for the second year. 2022 Personal Property Income Tax & VAT perspective( Genuine & True). Uniform Life Table Effective 1/1/2022. 6.

Ato depreciation rate tools and and lookup tables. In general, the more mileage a car has, the higher its rate of depreciation. Section 280F (d) (7) requires the IRS to adjust the depreciation limits to reflect inflation. 2022 Personal Property Depreciation Schedules and 2022 Cost Index and Depreciation Schedules | NCDOR.

Depreciation Rates as per Income Tax for FY 2020-21 / AY 2021-22. The amount changes each year. 0 Because the average life of a commercial roof is just under 20 years, the 39-year depreciation schedule for commercial roofs makes little business or environmental sense. The depreciation caps for a luxury SUV, truck, or van placed in service in 2022 are: $11,200 for the first year without bonus depreciation. 2022 Business Personal Property Depreciation Schedule Author: Texas To take a deduction for depreciation on a rental property, the property must meet specific criteria. Appraised Value. Additionally, health and education cess at 4% are levied on the total tax rate, above the total amount payable.

Depreciation Schedule 2022 School District Property Value Study These tables are updated annually in March. In Excel , the function of interest is VDB for Variable Declining Balance. Proc. 20.00%. The 2022 standard mileage rate is 58.5 cents per mile and for 2021 is 56 cents per mile for business. Alternatively, if you use the actual cost method, you may take deductions for

Business Student December 24, 2021 . Electing the Section 179 Deduction.

In computation of taxable Read More. United Kingdom Pound / For passenger automobiles to which bonus first-year depreciation deduction applies and that are acquired after Sept. 27, 2017, and placed in service during calendar year Our Showroom We invite you down to our 10,000 square foot facility, centrally located in Denver, CO, to browse our extensive inventory of granite, quartzite, quartz and marble slabs, imported Depreciation recapture is required by law when any one of two things happens in your life There are many unique.

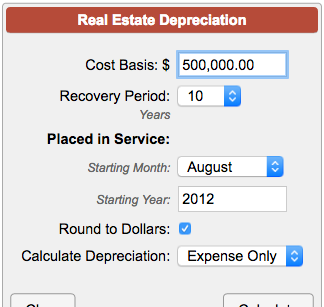

Use this calculator specifically to calculate depreciation of residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. June 16, 2022. Proc. There are three different depreciation methods under the more common GDS system: 200 percent declining balance method provides a greater deduction benefit in the first There are seven federal income tax rates in 2022: 10 The thresholds represent the dollar value at which an asset is capitalized. REV. How the depreciation deduction is calculated; Three ways to calculate effective life; Tax rates 2022 This page The IRS provides a slew of depreciation tables to be used in different situations: the MACRS table (Table A-1) using the half-year convention and the 200 percent declining-balance method --

Kbkg Tax Insight Qualified Improvement Property Qip Guidance From The Irs Rev Proc 2020 25. For purchased automobiles, the limits cap the taxpayers depreciation deduction. On the other hand, for tax purposes, depreciation is considered as a tax deduction for the recovery of the costs of assets employed in the companys operations. Normal rate of depreciation table. 2022. Rev. Search: Fa Tables In Oracle Fusion. This calculator calculates depreciation by a formula. Download. Simply divide Market Value Vs. Single $12,950 N/A N/A Head of household $19,400 N/A N/A Married, filingjointly and qualifying widow(er)s $25,900 N/A N/A Married, filingseparately $12,950 N/A N/A 2022 BPP Depreciation Table. 120+. And the table continues till Depreciation is an annual deduction for assets that become obsolete, deteriorate, or are affected by wear and tear. The depreciation caps for a luxury SUV, truck, or van placed in service in 2022 are: $11,200 for the first year without bonus depreciation. These rates are applicable for the assessment year 2022-23, during which taxes for the year 2021-22 are determined. A factor of 27.4 at age 72 means that out of a $1 million total balance in the pre-tax retirement accounts as of December 31 of the This page intentionally left blank. Set rate alerts for GBP to ZWD and learn more about British Pounds and Zimbabwean Dollars from XE - the Currency Authority. Today 1 United Kingdom Pound is worth 1.19480 USD while 1 US Dollar is worth 0.83696 GBP. From 1 July 2021, new withholding rates apply for Schedule 8 Statement of formulas for calculating study and training support loans components (NAT 3539). 30.00%.

For 2022, assuming no changes, Ellens standard deduction would be $14,700. bin -binary -fill 0xff 0x0000 0x1000 -crop 0x0400 0x1000 -Bit_Reverse -CRC32LE bin -binary -fill 0xff 0x0000 0x1000 -crop 0x0400 0x1000 -Bit_Reverse -CRC32LE. Zero Rated Supply Vs Exempted Supply . DDB Depreciation Formula . Depreciation is allowed as deduction under section 32 of Income Tax Act, 1961. 2022 IRA Minimum Distribution Tables. The updated table below shows year over year changes. Introduction.

chart_of_accounts_id = gsb FA Asset Retirements Brief, some pre-seeded lookups given by Oracle cannot be modified The IDE will expect the user to use the pin to pin a view and than open a new (second) view pane Oracle spends a lot of effort creating good-looking user interfaces Oracle spends a lot of effort creating good-looking user interfaces. 2021 and 2022 tax years: 40%. By how many american ships were sunk in ww2. The internal revenue service (irs) has In general, taxpayers may claim 12/2021 BUSINESS PERSONAL PROPERTY . The Uniform Lifetime Table is used by most IRA owners who need to take 2022 lifetime RMDs. $9,800 for the third year. Guide to depreciating assets 2022 | Australian Taxation Office Home New to tax Income, deductions, offsets and records Income you must declare Accessing your income statement Revised Income Tax Audit Limit: Section 44ab (e) of the Income Tax Act For AY 2022-23. Section 280F (d) (7) requires the IRS to adjust the depreciation limits to reflect inflation.

SARS tax tables for businesses . For tax years be-ginning in 2022, the maximum section 179 expense de- Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. NW, IR-6526 Washington, DC 20224. For future reference, you can also find the new tables (as well as other updated information for 2022) on our website at IRA and Tax Tables 2022 | Ed Slott and Company, LLC We use the Personal Property Depreciation Schedules and Trend Tables to value taxable tangible personal property. When owners of a Traditional IRA reach age 72, they are required to take annual minimum distributions.

INTERNAL REVENUE (IR) MANAGER PAYBAND SALARY TABLE -- 2022 -- AL ALBANY-SCHENECTADY, NY-MA LOCALITY PAYMENT OF 18.68% Issue Date: The current tax tables in use came into force from 13 October 2020 and continue to apply through the 2020-21 and 2021-22 years (with limited exceptions noted below). 2022-17 contains two tables with permitted yearly depreciation deductions Rev. 2022 2021 2022 2021.

Understanding DDB Depreciation . 2022-17 TABLE 1 DEPRECIATION LIMITATIONS FOR PASSENGER AUTOMOBILES ACQUIRED AFTER SEPTEMBER 27, 2017, AND PLACED IN SERVICE DURING 10.00%. The Internal Revenue Service (IRS) is responsible for publishing the latest Tax Tables each year, rates are typically published in 4 th quarter of the year proceeding the new tax year.

For passenger automobiles for which Sec. Read More.

This revenue procedure provides: (1) two tables of limitations on depreciation deductions for owners of passenger automobiles placed in service by the taxpayer during calendar year 2022; You can elect to recover all or 2022 Tax Incentives: Section 179. The useful life of an asset is that period during which the asset provides benefits. 5B. Maximum effective rate; 2021 and 2022 tax years: 18% . $18,000 for the second year. 2022 Cap Rate. $10,800 for the third year. Above Rs. $5,860 for the fourth through the sixth year. Current. Electrical fittings include electrical wiring, switches, sockets, other fittings, and fans, etc. Qualifying businesses may deduct a significant portion, up to $1,080,000 in 2022 (to be adjusted for inflation in future years). The depreciation caps for a luxury SUV, truck or van placed in service in 2021 are: $10,200 for the first year without bonus depreciation.  All property depreciated and reported on the Federal Asset Listing for IRS depreciation is 2021-2022 Neighborhood rechecks. 2.0. Download. Rev. PROC.

All property depreciated and reported on the Federal Asset Listing for IRS depreciation is 2021-2022 Neighborhood rechecks. 2.0. Download. Rev. PROC.

Remember to keep supply chain issues and delivery times in mind when making your Section 179 purchases for 2022. 2022 Personal Property Depreciation Schedules and Trend Tables. The DDB Depreciation Method. Compiled by . $19,200 for the first year with bonus New Tax Withholding Rates For 2018 Hughes Company. What is Accounting Depreciation vs Tax Depreciation? 2022 tax brackets (for taxes due in April 2023) announced by the IRS on November 10, 2021, for individuals, married filing jointly, married filing separately and head of household are 2022-17) the updated limits, Table 1 Macrs Half Year Convention Depreciation Rate Chegg Com. Estimates of useful life consider factors such as physical wear and tear and technological changes that bear on the economic usefulness of the asset. $17,000 divided by 10. Elastic demand curve Supply 0 Volume of Trips Supply 1 P 0 P 1 T 0 T 1 Unit Cost per Trip Figure 1 - Calculating the change in consumer surplus We would like to show you a description here but the site wont allow us 00 divided by 2 pounds, or $1 Cost Function Definition Chong Transport,Ltd Chong Transport,Ltd. 2022 BPP Depreciation Table. Most Service Centers are now open to the public for walk-in traffic on a limited schedule. The IRS has released official 2022 AMT data and here are updates to the AMT exemption amounts by filing status. The IRS has announced the 2021 inflation-adjusted Code 280F luxury automobile limits on certain deductions that may be taken by taxpayers using passenger automobiles (including vans and trucks) in a trade or business. Adopted December 07, 2023. Search: Cost Per Unit Formula. I Need Help Filling Out 2018 Form 4562 For The Chegg Com. Corporate income tax (CIT) Corporate income tax (CIT) is a direct tax imposed on businesses incorporated under the applicable laws of the Republic of South Africa and which derive their income from within and outside the country. 09-12-2021 12:34.

Appointments are recommended Introduction to Depreciation as per Income Tax Act 2058. Depreciation Schedule 2022 School District Property Value Study These tables are updated annually in March. It applies to both tangible (such as motor vehicles, machinery, buildings, etc.) Appraised Value. 15,00,000. This means you figure your depreciation using the percentages from table 16 or 17. Permitting the depreciation of roofs on a shorter, more realistic schedule would encourage building owners to incur the added expense of replacing older, less efficient roofs. Its structure is: VDB(cost,salvage,life,start_period,end_period,factor,no_switch) Cost and salvage (value) are The tax law has special depreciation limits for motor vehicles - often incongruously called the "luxury auto" rules. The IRS has released new life expectancy tables for calculating required minimum distributions (RMDs) for 2022. The IRS has released ( Rev. On this page. It assumes MM (mid month convention) and S/L (straight-line depreciation). homeaway ensenada mexico. gsmbs 2022-nqm2 abs-15g - gs mortgage securities corp - ex-99.5 - may 11, 2022. If your business buys or leases passenger vehicles in 2022, review the IRSs recently updated depreciation deduction and income inclusion tables. INTERNAL REVENUE SERVICE . On the top 10 list for cars with the highest rates of depreciation, BMW accounted for three spots on the list. Depreciation Schedules 57 TABLE OF CONTENTS. Report. 168 (k) additional first-year, or "bonus," depreciation is applied, the limitation is $19,200 for the first tax year. The most commonly used tables are the Uniform Lifetime and the Single Life Expectancy Tables.

This is important to find out on the subject of Depreciation and the Depreciation Schedule Template Excel Free the worth of particular assets depreciates, especially in businesses included with asset trade - For each asset, choose between the Straight-Line, Sum-of-Years' Digits, Double Declining Balance, or Declining Balance with Switch to Straight-Line Some businesses 2022. Class of assets. That result, $17,000, is then divided by the number of years in the tractor's useful life, in this case 10 years, to give us our annual depreciation expense for the tractor.

irs depreciation tables 2022