Jan. Rs.

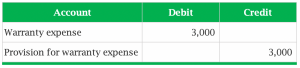

Selling Your Practice. This year we need a provision of 2% * $32,000,000 * 25%.  The element of probability that gives rise to uncertainty of whether the event will occur or not makes the provisions from the regular accrual expenses.

The element of probability that gives rise to uncertainty of whether the event will occur or not makes the provisions from the regular accrual expenses.

Journal Entries For Provisions Are Provisions Non-Cash Expenses?

Audit Fee A/c Dr .

no credit is available on the same, since it is consumed by you.

As a result, a cash account credited by 40% of $60,000 is $24,000.

Accounting and journal entry for credit sales include 2 accounts, debtor and sales. Debit.

Later when the liability is paid, you would debit Liability account and credit Cash account. To record the sale of 1,000 units, the company would make the following journal entries at the time of sale: Account Titles. get included in the VAT return.

This offsets the Net Cost of Sales = $600,000 - 60,000 = $540,000.

So the journal entry reflects the adjustment required: Use the following steps for the same.

June 2015.

Step 4. February 2016.

For information, see Making Advanced Intercompany Journal Entries.

Once certainty is found regarding the settlement of the debt the necessary credit notes raised, the bad debt provision should be reversed. Expense account will appear on Income Statement and Liability account will appear on Balance Sheet. For example, assume your small business sold a $200 product and charged 10 percent sales tax, or $20, which consists of state, county and city taxes. Include Sales Tax in Your Sale.

ASC 606 replaces the ad-hoc, industry-specific, rules-based approach of legacy GAAP with a principles-based

1 Commenced business with cash 2,00,000.

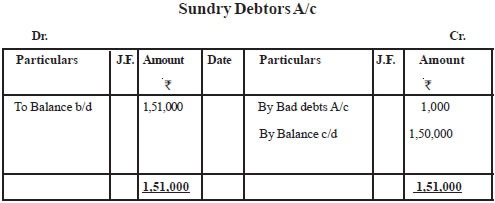

Concept And Journal Entry For Inter-departmental Transfers. (being cash received from Mahesh and bad debts written) Bad is loss and shown in the Debit side of Profit and loss accounts therefore it reduces the profit of the firm. Purchase Transactions (Input Supplies of Goods or Services) 2.

August 2015.

On the "Credit" column of the "Accounts Receivable" row, enter the value of money owned by customers who have bought the expected-to-be-returned toys on credit, while on the "Credit" column of the "Cash" row, add the amount of cash you earned from selling the expected-to-be-returned toys. Read More!

An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred.

So we are able to release $200,000 of that provision figure brought forward:

120,000.

The journal entry is debiting accounts payable and credit cash.

From the following transactions, pass journal entries for the month of January and February, 2018. GST Regime Types of Ledger Accounts to be Maintained Under GST.

Set Off of Input Credit Against Out Tax Liability of GST.

As a result, a cash account credited by 40% of $60,000 is $24,000.

As a result, a cash account credited by 40% of $60,000 is $24,000.

An example of sales journal with a sales tax payable column is given below: The sales journal given above shows that the seller is collecting a sales tax @ 2% on all goods sold to customers. M Venkat (CA finalist) (446 Points) Replied 18 January 2021.

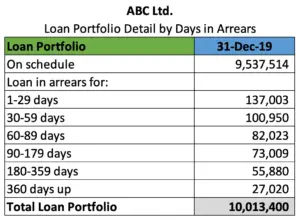

Automatic allocation journal entries calculated from balances in the ledger at month-end. Deepak is a dealer in stationery items. ASU 2014-09 Topic 606 (ASC 606), Revenue from Contracts with Customers, has been called the biggest change to financial accounting standards in the last 100 years. We have assumed that ABC already had a provision for trade debtors, but this was only for $1,000.

2000.

Pass journal entry in the books of X company limited for two year .

The entry is: Record Indirect Production Costs in Overhead

Step 2. To TDS on Professional Charges (194J) A/c .

September 2015. Illustration 15.

$150.

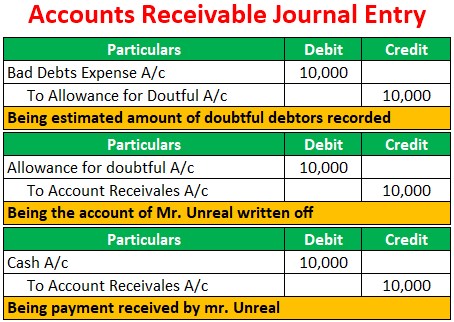

The Original Entry is: Debit : Provision for doubtful debt ( Income Statement) 100,000. Credit: Provision for doubtful debt ( Balance Sheet) 100,000. The journal entry in the above example would therefore be: Dr Bad Debts (profit & loss account) 4,000.

Other articles by this author . SGST A/c Dr .

a.

With regards your year-end adjusting journal entries (AJE), one of the entries should be to record a tax provision for 2011. Annual Depreciation = Cost of Machinery Best Boots buys an office printer for Designer Doors for $220.00. Your entry is between your payable/receivable and bank accounts so you clear your outstanding payable/receivable: Dr. Cash in Bank.

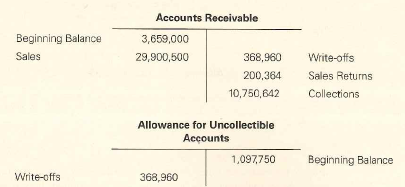

The company only make journal entry when a specific receivable is considered uncollectable due to a specific reason.

First, calculate the amount of sales return. Below are the examples of provisions for a bad debt journal entry.

A Sales book is also called Sales Journal or Sales Day Book.

2% sales returns $32,000,000 sales revenue 25% profit = 2% * $32,000,000 * 25% = $160,000 Last year there was a provision of $360,000 and this year that figure falls to $160,000.

Practice Sales.

That is, when the current estimates of total revenue (i.e., consideration) and total contract cost remaining to fulfill the job indicate a loss, the entire value of the loss would be recorded against a loss provision (i.e., an accrued contract expense and a liability). The posting of this sales journal will be similar to the posting explained in the above example. $200. Streamline provisions and every other part of the accounting cycle with cloud-based software like Deskera. The result in B1 would be $422, because this would be the remainder of dividing $10,422 by $1,000. Since the departments are just under the single roof and involved in exchanging their goods or employment staff or performance of services among the different departments, which is known as inter-departmental transfer.

A return occurs when a buyer returns part or all of the merchandise they purchased back to the seller. It is part of the adjusting entries in the accounting cycle that each accountant shall be carried out as part of their closing process.

First, calculate the amount of sales return.

Many companies sell goods on either cash basis or credit basis. Bad debts is the amount of credit sales which can not be recovered or become irrecoverable are called bad debts.

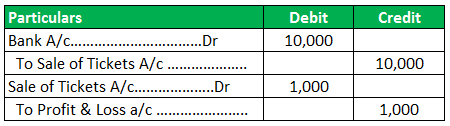

The two different entries will be explained below: Journal Entry for Cash Sales.

This may happen due to several different reasons, in business terminology, this action is termed as Sales returns or return inwards. Account.

3 A 4 papers sold on credit to Padmini and Co. 60,000.

For this transaction the Accounting equation is shown in the following table. Direct write-off is the accounting method that directly reduces the accounts receivable balance to bad debt expense on income statement.

Journal voucher in Tally is an important voucher which is used to make all kind of adjustment entries, credit purchases or sales, fixed assets purchase entries.

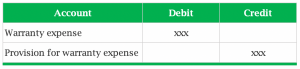

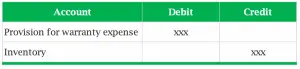

On the other hand, the credit impact of the transaction is the removal of resources that have been utilized in the exercise of Warranty.

This time though, the credit is to repair parts stock.

10,000.

$24,000,000 sales revenue 20% profit.

To Mahesh.

Step 1. 12,000. March 2016. Dr Sales Return Allowance / Revenue (5*50) = $250 Dr Sales Return Allowance / Revenue (6*25) = $150 Cr Account Receivable (ABC Cosmetics) = $400

For example, the following entries of sales appear in the books of ABC Ltd. Jan 7 Sold 10 Keyboards to A & Co. for 300 each. Note that (1) the system creates the voucher for the item plus the tax, and (2) the posting creates two entries.

It is considered as the business loss of the company and reduced the accounts receivable amount from the books of accounts. In accounting terms, a provision account is a current liability and shown on the Liability side of the balance sheet.

100000/- was deposited in SB BANK Fixed Deposit A/C Dr 100000 To SB BankA/C 100000 (Being fixed deposit was done in SB) Rules for passing Journal entry Debit Fixed deposits are treated as non-current asset or current asset is depended on maturity period, if maturity period is less than one year from the date of  These are books used in accounting. It is a result of accrual accounting and follows the matching and revenue recognition principles. Sales book of

These are books used in accounting. It is a result of accrual accounting and follows the matching and revenue recognition principles. Sales book of

Journal Entry for Sales Returns or Return Inwards. ASU 2014-09 Topic 606 (ASC 606), Revenue from Contracts with Customers, has been called the biggest change to financial accounting standards in the last 100 years.

The Company Tax Rate is 28.5% and thus the projected tax will be $14,250.00.

In the income statement it will be reported as following: Miar Company.

1. Jan 24 Sold 5 headphones to X & Co. for 200 each.

As per this percentage, the estimated provision for bad debts is $12,000 ( [$110,000 $10,000] x 10%).

CGST A/c Dr .

Company X will record the Provision for Bad Debts with the following journal entry: The following year, Company X has ascertained that Customer A has filed for bankruptcy and will no longer be able to recover the outstanding amount due from them in the amount of $15,000. Now, George passes the journal entry.

The supplier has delivered the goods alongside the invoice. The first thing that needs to be done is to reverse the sale.

For information, see Making Advanced Intercompany Journal Entries.

All campus activities are accounted for within Operating Units (cost centers).

The journal entry is debiting accounts payable of $ 10,000 and credit cash at bank $ 10,000.

If you are accounts savvy, you can record the same payment transaction using a journal voucher in TallyPrime.

Step 3. The loan journal entry in best boots is: Debit: Designer Doors Loan Receivable(asset * account) Credit: Bank (asset account) *This loan entry goes to assets because cash is expected to be received into the bank.

View more You have used a journal to record a the provision but one is able in xero to make a journal entry VATable, i.e. The cash account is an asset account and therefore when it increases we debit the account. CR Sales Revenue 390000 Management expects that 20% of the Garbucks awarded to customers will never be redeemed." and for consumer no credit is available.

Journal Entry for Fixed Deposit Fixed deposit Rs.

Now, George passes the journal entry.

Journal entry for sales returns or return inwards is explained further in this article. Conclusion

In a dynamic environment, credit sales are promoted to keep up with the cutting edge competition.

Sales Returns Journal Entries.

Being creation of provision for doubtful debts at Quarter 1.

The journal entry for bad debts is as follows: Debit: Bad debts (expense) Credit: Debtors control account (asset) What this journal entry means is that we are recording the loss of the money we expected to get in in the future (from Mr. T, our debtor). About Anita Forrest. You have to record the below journal entries for TDS in your company books of accounts. November 2015.

Journal Entries for Provisions for Expenses at the end of Financial Year: 12,000.

Accounting with Journal Voucher.

Provision is an account which recognizes a liability of an entity.

Gateway of Tally > Transactions (Vouchers) > F7: Journal.

In Quarter 2, We increase the provision by an additional $50,000 namely:-

The journal entry for inter-departmental transfer would be as follows: Date. However, ABC Co. already has $7,000 in the provision for doubtful debt accounts from the previous year. Add $200 and $20 to get $220.

The journal entry for inter-departmental transfer would be as follows: Date. However, ABC Co. already has $7,000 in the provision for doubtful debt accounts from the previous year. Add $200 and $20 to get $220.

When Depreciation is credited to Provision for depreciation Account. Here the sales return is 10% of $6,00,000 (thus, 10% of $6,00,000 is $60,000).

When Depreciation is credited to Provision for depreciation Account. Here the sales return is 10% of $6,00,000 (thus, 10% of $6,00,000 is $60,000).

Operating Units segregate activities into their appropriate fund category.

Such liabilities are normally related to unpaid expenses. Below is the journal entry to record sales return and allowances under the periodic inventory system: Account Name.

Downloads this Tally Exercise : Provision Entries ( this practice has been downloaded 10681 times) June 2016.

Downloads this Tally Exercise : Provision Entries ( this practice has been downloaded 10681 times) June 2016.

An allowance occurs when a buyer decides to keep damaged or defective goods but at a reduction from the original price.

New provision of 2% of 200000 which comes Rs 4000 . Please note that accounts receivable is credited in case of Club B because the amount was still outstanding at the time of the sales return.

10,000.

This example is valid for both advanced and legacy intercompany journal entries.

A provision should not be understood as a form of savings, instead, it is a recognition of an upcoming liability, in advance. Alternatively,

A provision should not be understood as a form of savings, instead, it is a recognition of an upcoming liability, in advance. Alternatively,

Intercompany Everyday Expenses.

You may configure Use Cr/Dr instead of To/By during voucher entry by pressing Press F12: Configure as per your preference. Credit Income Tax Payable $14,250.00. This new standard was issued jointly by FASB as ASC 606 and by the IASB as IFRS 15. The cost of goods sold and a reduction in merchandise inventory is not recorded.

Sale Transactions (Outward Supplies of Goods and Services) 3.

Then, we need to correct the team's credit account so The total amount of invoice including expenses and Taxes was 25000$ which has to be paid on or before Apr01, 2019.

Net Sales = Sales - Sales Returns and Allowances. The debit will be to either the raw materials inventory or the merchandise inventory account, depending on the nature of the goods purchased.

Net Sales = $1,000,000 - $100,000 = $900,000. read more is 5,000 ; ABC Inc sold some electronic items to Mr. John Stewart on Mar01,2019. Gateway of Tally > Transactions (Vouchers) > F7: Journal.

Corporate Income Tax Payable (Refund) Cr.

This resource was uploaded by: Reetika.  The journal entry of the above entry will be: Bad debts A/c Dr. 90,000.

The journal entry of the above entry will be: Bad debts A/c Dr. 90,000.

International Accounting Standard (IAS) 37, released in July 1999, sets out the criteria and rules for accounting for provisions. Solution: Calculation of Annual Depreciation-. I would recommend only making the provision after 6 months and always claim the VAT back.

International Accounting Standard (IAS) 37, released in July 1999, sets out the criteria and rules for accounting for provisions. Solution: Calculation of Annual Depreciation-. I would recommend only making the provision after 6 months and always claim the VAT back.

The journal entry for accruals is as follows: Dr Expense Account (P&L) Cr Accruals (Balance Sheet) The debit side of this journal increases the expense account balance (i.e.

The sum of these two figures provides us with a provision figure we can use for the journal entry.

We account for this by the following end of year journal entries: Debit Income Tax Expense $14,250.00.

Example During the month, company ABC purchases the inventory from supplier for $ 10,000 on credit.

Step 4. You may configure Use Cr/Dr instead of To/By during voucher entry by pressing Press F12: Configure as per your preference.

Not to be confused with a credit entry to inventory, which is a credit to the finished widget asset account.

The bookkeeping entry would be: Debit (increase) Provision for Income Taxes (an expense on your income statement) Credit (increase) Income Taxes Payable (a currently liability on your balance sheet) Then, when you pay your estimated taxes, due two months following your fiscal year-end, you would book the following bookkeeping entry:

Here are the entries to record these sales returns, 3.

This journal entry will make full settlement of the accounts payable that ABC has with the supplier. Or, if cell A2 had $100,000 in it, then MOD (A1,1000) would result in a zero value, which would indicate a round number.

When the tax is paid to the ATO, we do the following: Debit Income Tax Payable $14,250.00. 40.

Actual sales in next quarter will increase the liability balance and actual claims will reduce the balance. Follow.

An example of sales journal with a sales tax payable column is given below: The sales journal given above shows that the seller is collecting a sales tax @ 2% on all goods sold to customers.

An example of sales journal with a sales tax payable column is given below: The sales journal given above shows that the seller is collecting a sales tax @ 2% on all goods sold to customers.

May 2015.

Journal Entry for Credit Sales and Cash Sales Sales are a part of everyday business, they can either be made in cash or credit.

One entry is to the A/P Trade account and the second is to the Sales & Use Tax Payable account.

Debit.

4.

In the sellers books, a return or allowance is recorded as a reduction in sales revenue.

Note: here provision for bad debts for last year is given in trial balance is given.

Examples of Account Receivable Journal Entry.

Generally, adjusting journal entries are made for accruals and deferrals, as well as estimates. Inventory [= 10 $15] $150.

Journal Entry for Bad Debt Provision.

TDS on Professional Charges (194J) A/c Dr . #Accounting #Bookkeeping basics. To Bank A/c A provision is usually an amount that is set aside from a companys profits, usually to cover an expected liability or a decrease in the value of an asset, even though the specific amount of the same might be unknown.

When a payment is made for the full amount for instance then entries are CR sales Ledger Dr Bank.

DR Customer Loyalty provision 10000. Sometimes due to various reasons goods sold by a company may be returned by the respective buyer (s).

We use the allowance method to deal with bad debt, so the net book value of their accounts on the balance sheet is already zero.  Our latest accounting tutorial covers the accounting for provisions under IAS 37, with journal entries and detailed guidance.

Our latest accounting tutorial covers the accounting for provisions under IAS 37, with journal entries and detailed guidance.

sales provision journal entry